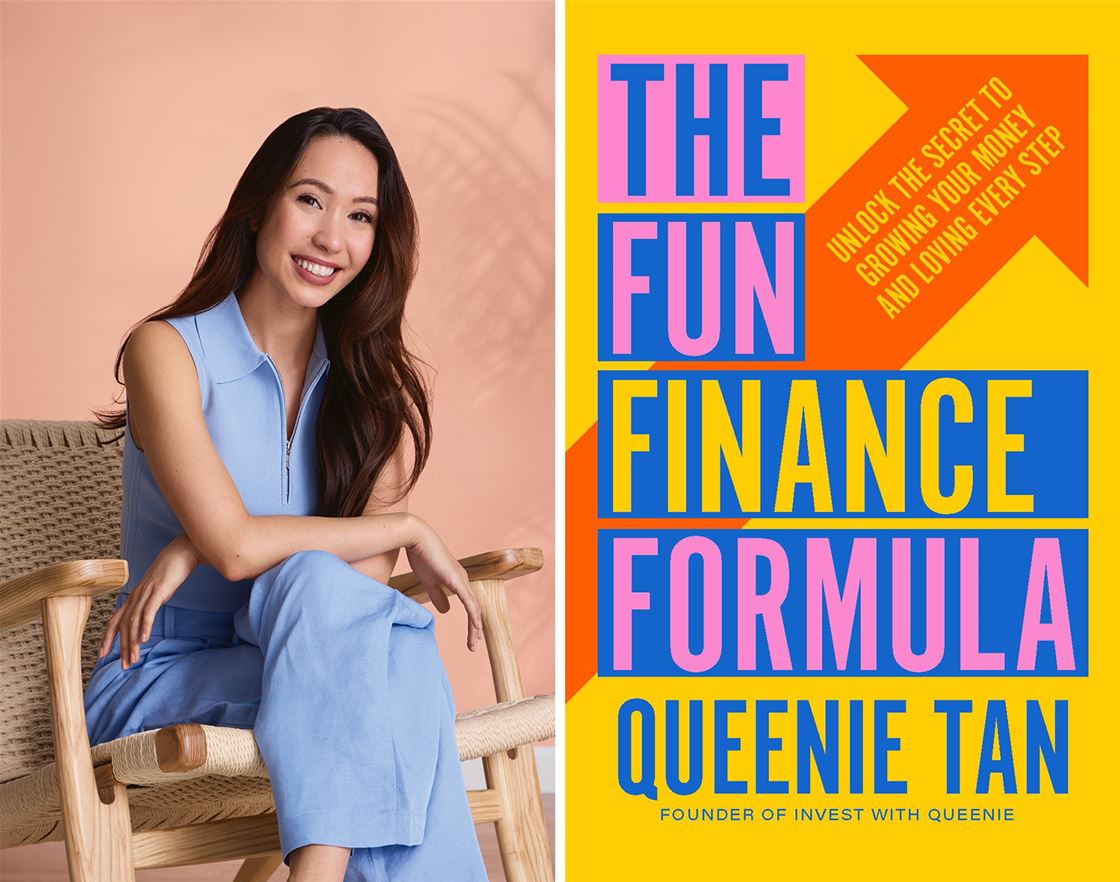

queenie tan wants to reframe the way that you think about money

Personal finance content creator Queenie Tan shares an excerpt from her upcoming book, 'The Fun Finance Formula'.

When you ask people to describe money, you can get some very different responses. To some people, money is the root of all evil. To others, money is good and can be used to help achieve their dreams.

But here’s an idea that will change how you think about money: all these perspectives are correct because there are different types of money. There’s happy money and sad money, as Ken Honda – author of Happy Money – would say, but I like to see it as fun money and draining money. I believe money can also be lucky or skillful. So, let me explain!

FUN MONEY VS DRAINING MONEY Fun money is the kind you earn or spend with joy. Think of a Christmas gift from your grandma or a paycheck from a job you love – it’s money that feels good. For example, when I set up an investment account for my daughter Gia on her birthday, I felt so much joy knowing that I was doing something meaningful for her future. And when she receives that money, she will feel its happy energy. That’s fun money. Whenever you can, aim to give and receive fun money.

On the other hand, my parents spent a lot of money in court when they got divorced, and this was money they both regretted spending. That was draining money – money tied to stress and unhappiness. Like paying for a parking ticket or earning money from a job that drains you, this type of money leaves you stressed, frustrated or regretful. Draining money weighs you down. It makes building wealth feel like a burden, draining your motivation. This perpetuates the cycle of draining money.

This is why some people think money is “evil”, because sometimes it can be. To them, money might only remind them of draining experiences. But as we’ve seen – and I’m sure you’ve felt this too – money can also be good. It can bring happiness and be used in ways that feel uplifting, positive and joyful.

The goal is simple: try to create and use as much fun money as possible. Sometimes, draining money is unavoidable, life happens after all, and things happen that you can’t predict. But when you make an effort to earn, spend and give money in ways that feel good, joyful and meaningful, money becomes something positive – not just for you, but for others too.

This shift makes building wealth easier and guilt-free. When you earn fun money from work you enjoy, it feels fulfilling. And when you spend it joyfully, you pass that positive energy on to others, creating a cycle of fun money.

But here’s the thing: not all fun money is in your control. Some money takes effort, while other money feels lucky. That’s where the real magic happens – understanding the overlap of these types.

LUCKY MONEY VS SKILLED MONEY Lucky money feels effortless and happens by chance. You have little control over this money. It might be winning the lottery, receiving an unexpected gift or making a risky investment on a random meme coin. Lucky money flows naturally, without much effort or planning on your part.

The downside of lucky money is its unpredictability. It’s hard to replicate or scale, and since it’s tied to external factors, you can’t control when it happens, or if it happens again.

Skilled money, on the other hand, is money earnt through deliberate effort, knowledge or expertise. It’s the money you work long hours for, learn new skills for, and figure out ways to build creative systems for.

Skilled money takes effort upfront, but once mastered, it can often transform into something more consistent and reliable. Of course, some luck is still involved in order to succeed, but you have much more control over it compared to lucky money. For example, building a business or learning to invest takes time and dedication – but over time, it creates opportunities for consistent returns. Skilled money is more fulfilling because it’s tied to your abilities, giving you more confidence in your financial future. And the best part is, it gets easier over time.

HARD CHOICES, EASY LIFE; EASY CHOICES, HARD LIFE There’s a personal development quote from Jerzy Gregorek that I love: “Hard choices, easy life. Easy choices, hard life.” The way I interpret it is this: taking the easy path now often makes life harder in the long run, while making hard choices today sets you up for an easier future.

Let’s think about something as simple as brushing your teeth. If you skip brushing for a day, it’s no big deal. Nothing disastrous happens. You’re not going to wake up the next morning to your teeth falling out. But what if you didn’t brush for a year? Or five years? Things start to change. You might get cavities, develop gum disease or even lose teeth. Suddenly, what seemed like a small, easy choice in the moment has snowballed into painful dentist visits, costly treatments or permanent damage. The “easy” choice of not brushing becomes the “hard” reality of dealing with the consequences.

Now let’s apply this to money. Spending everything you earn in the present often feels easy. Treating yourself, eating out and buying things you don’t really need can feel good in the moment. But if you consistently choose to spend instead of saving or investing, future-you ends up with a much harder life. Unexpected expenses, missed opportunities or a lack of financial freedom can weigh you down when it matters most.

On the flip side, making the hard choice to save, budget or invest today takes effort. But those small, disciplined actions add up to big rewards over time. Hard choices – like sticking to a budget, paying off high interest debt or investing – lead to financial freedom, stability and the ability to live life on your terms.

The lesson here isn’t about deprivation or living in fear of the future – it’s about finding balance. You don’t need to give up all the joys of today for tomorrow’s security. Instead, ask yourself: how can I balance enjoying life now while still setting myself up for the future I want?

This principle applies to both money and life in general. The choices you make today shape the life you’ll have tomorrow. The key is to be intentional, even when it’s hard, because those hard choices are what make the easy life possible.

For more small-business stories like this, visit frankie.com.au/strictly-business, or sign up to our monthly e-newsletter. Have a small-business story you’d like to share? Pitch it to us.

.jpg&q=80&h=682&w=863&c=1&s=1)

.jpg&q=80&h=682&w=863&c=1&s=1)

.png&q=80&h=682&w=863&c=1&s=1)

.jpg&q=80&w=316&c=1&s=1)

.jpg&q=80&w=316&c=1&s=1)