a little help buying a home

A few tips for folks who want to buy a house but don’t know where to start.

Keen to say farewell to your pesky landlord, the drab kitchen you can’t remodel and the icky feeling you get when you’re paying off someone else’s mortgage? Maybe you’re living with your parents, and your dad’s taste in TV is driving you mad? Public discourse about home ownership can be pretty doom and gloom, but it’s not completely out of the picture for young folks who are super-interested in getting into the market. If you have your heart set on an abode of your own, but don’t know how to go about it, here’s a few ways to begin. (FYI, this list is not exhaustive, but it might be the kick up the arse you need to get started.)

Get up close and personal with your finances

If you’re the type of person who hated maths in school and would rather go to the dentist than dissect your spending habits, we can totally relate. Understanding the ins and outs of your financial worth (and earnings potential) is pretty confronting, but you’ll feel so much better when you know exactly where you stand (we promise). Break down your fixed expenses (the money you know you spend on rent, utility bills and car payments), and all the moolah you have laying around (everything from your superannuation account to the $50 bill your nan gave you for your birthday). That way, you can start planning and making realistic goals based on your personal situation.

Become a finance nerd

Finance doesn’t have to be boring. There are so many resources for young folks who are interested in economics and money matters — from podcasts to finance-related social media accounts — and they’re not all run by yawn-inducing dudes that sound like the teacher from Ferris Bueller. They can help you become your own expert in subjects like investing, loans, interest and the housing market. Think of financial education as your new hobby, so that when the time comes to buy, you’ll be confident in making decisions that you know will be right for you.

Consider alternative options

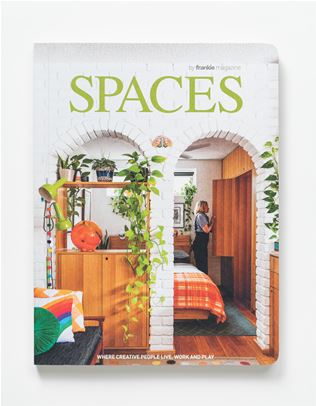

Buying a home doesn’t always look the way it’s portrayed on TV (we’re looking at you, The Block). There are pathways to homeownership that avoid the stressy auction process, which often disadvantages first-home buyers. And you may not have the skills or the resources to do a full remodel. Consider buying land, instead, and building your own home with a specialist homebuilder like Metricon. There are heaps of benefits for first-time home owners: not only will you get to design the home you want, you can save dosh on stamp duty (which is cheaper on land than an existing home), avoid problems updating an older house and work with experts who can guide you through the whole process. Metricon has been in the business of building homes for Aussies for yonks, too, and they also offer HomeSolution, which is designed specifically for first-time homebuyers. With as little as 5K^ and a savings plan, financial specialists* can walk you through government grants, exemptions, design questions and other things you need to do to hop onto the property ladder. Plus, you can get to make choices on how your home looks, which means there’s no need to deal with ugly light fixtures or pulling up old floors. Three cheers for that!

Play the long game

Though we all wish we could snap our fingers and move straight into our dream home, homeownership is a process that takes time (especially if you’re a first time homebuyer). Remember that buying an abode is one of the biggest grown-up decisions you can make, so embrace the process and enjoy the journey. If you keep stress levels down, you’re more likely to find a home that’s right for you. Good luck!

*A little bit of fine print

^To be eligible, customers must (a) qualify for Victorian Government’s First Home Owner Grant (FHOG); (b) pay $5,000 with the balance of 5% deposit funded through the FHOG plus a savings plan, applied to land and build contract deposits, government charges and lending costs; (c) qualify for the HomeSaver program provided by Phoenix Mortgage Management Pty Ltd (Australian Credit Licence 393868) which assists customers save the funds needed to obtain a home loan & (d) qualify for a home loan. Offer is available on HomeSolution home and land packages in Select estates only.

*In Victoria, credit assistance is arranged through Loan Gallery Finance Pty Ltd ACN 163 825 670, Australian Credit Licence Number 475302. Lender’s mortgage insurance may be required, incorporated into home loan repayments. Lender’s terms, conditions, fees, charges and lending criteria apply. All loan applications are subject to lender’s approval. Metricon may vary this offer at any time & does not supply finance or land.

.jpg&q=80&w=316&c=1&s=1)

.jpg&q=80&w=316&c=1&s=1)